U.S. v. C.U.

Not Guilty on all Counts

Charles Unkle was a commercial aircraft pilot. After years of flying he developed a medical condition that led the airlines to ground him. Mr. Unkle chose to retire. He received a large settlement from his disability insurance. Mr. Unkle used an accountant to prepare his tax return. The accountant did not include the large disability settlement as income on Mr. Unkle's personal income tax return.

The IRS audited the tax return and assessed additional tax. The agent stated that unless Mr. Unkle paid all of the insurance premiums the payments had to be reported as income. The accountant did not amend the tax return. The following year Mr. Unkle once again received a large amount from the disability insurance company. Once again the tax return omitted the income.

The IRS indicted Mr. Unkle for willfully filing false returns. The government called the accountant as a witness. He stated that he told Mr. Unkle that the funds were taxable but Mr. Unkle provided him with a letter on aircraft stationary stating that 100% of the insurance premiums had been paid by Mr. Unkle. As a result, the accountant did not report the income. The IRS proved that the letter was a forgery and was bogus.

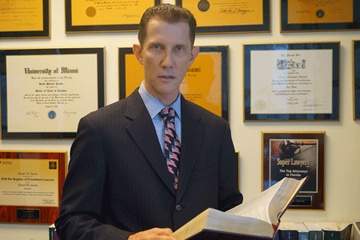

David Garvin represented Mr. Unkle and proved that the accountant had asked Mr. Unkle for a lone. Mr. Unkle declined because he owed taxes and had no extra money available to loan to the accountant. The accountant had the motive to reduce the tax bil and had the opportunity to create the phony letter. Finally, Mr. Garvin proved that the accountant had forged the name of one of his other clients on several checks and had been caught.

The jury found Mr. Unkle NOT GUILTY on ALL COUNTS.